LLP Registration Online

Get LLP name approval from MCA in 24 Hours

Register or convert a partnership into Limited Liability Partnership (LLP) with LegalShark’s company lawyer. Get special benefits from LLP registration.

- Incorporatin Certificate

- Name Approval

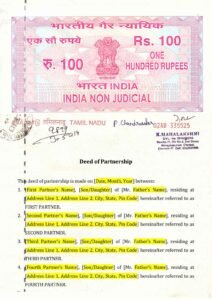

- LLP Deed

- PAN & TAN

- Free Monitering

- Free Legal Support

- Timely work

4.9/5.0 | 5000+ Happy Clients

5.0/5.0 | 2000+ Happy Clients

Talk to Expert

Here's How It works !

Register your trademark/logo in 3 easy steps.

1. Fill Form

Fill the above form to get started.

2. Call to discuss

Our expert will connect with you

3. Get Incorporated

Get your LLP Documents

Limited Liability Partnership (LLP) Registration in India

Launching a business in India? Limited Liability Partnership (LLP) registration offers a flexible and secure structure for your venture. Compared to a traditional company, LLPs combine the benefits of a partnership with limited liability protection for partners. This makes it an attractive option for entrepreneurs seeking to grow their business.

What is an LLP?

An LLP is a business structure that combines the features of a partnership and a corporation. It offers limited liability protection to its partners and provides flexibility in management and operations.

Features of LLP

An LLP, or Limited Liability Partnership, is a business structure that combines features of both a partnership and a corporation. Here’s a breakdown of what that means:

- It has a separate legal entity just like companies.

- Minimum two persons should come together as partners to establish LLP.

- There is no upper limit on the maximum number of partners.

- There must be a minimum of two designated partners.

- Atleast one designated partner must be a resident of India.

- The liability of each partner is limited to the contribution made by the partner.

- The cost of forming an LLP is low.

- Less compliance and regulations.

- No requirement of minimum capital contribution.

LLP Registration Online Process By LegalShark

Limited Liability Partnership (LLP) registration involves several steps to ensure legal protection and recognition.

Free Consultation

Consider consulting a professional lawyer to understand if an LLP is the right structure for your business and ensure you meet all eligibility requirements.

LLP Name Approval

We will file name approval application online to the government's MCA portal. Here, you can check for name availability and reserve a unique name for your LLP.

Drafting the LLP Agreement

Write up a deed agreement (called an LLP Agreement) that says how you'll share profits, roles and responsibilities of partners, Our company lawyer can guide you.

Digital Signature Certificate (DSC)

Each partner in the LLP will need a DSC. This acts like a digital signature for online verification and filing purposes. You can obtain DSCs from authorized agencies.

Online Filing

Now for the official part! Upload all your documents on the MCA portal: approved name reservation, LLP agreement, partner details with DSCs, and anything else the MCA requires.

Verification & Registration

The MCA will review your application and associated fees. Once everything is verified, Your LLP registration will be done successfully. We will send official LLP incorporation certificate.

Eligibility Conditions for LLP Registration in India

Thinking of starting a business with the benefits of a partnership and limited liability protection? An LLP (Limited Liability Partnership) might be the perfect fit! Here’s a breakdown of the essential requirements to register an LLP in India:

- Minimum Partners: You’ll need at least two partners to form an LLP. This allows for shared ownership and decision-making. Importantly, at least one of these partners must be a resident Indian citizen.

- Partner Flexibility: Partners can be individuals with the legal capacity to enter contracts or even other companies! This offers flexibility in structuring your business ownership.

- No Minimum Capital: Unlike some company structures, there’s no minimum capital contribution required to register an LLP. This can be a major advantage for startups or businesses with lower initial investment needs.

- Valid PAN Card: All partners involved in the LLP must possess a valid PAN Card (Permanent Account Number) issued by the Indian Income Tax Department. This is crucial for tax purposes.

- Legal Age Requirement: All partners must be of legal age to enter into binding contracts. This typically means being 18 years old or above.

Documents Required for LLP Registration in India

| For the Partners | LLP Details |

|---|---|

|

|

Proprietorship vs Limited Liability Partnership (LLP) vs Company

Here’s a table comparing Proprietorships, LLPs, and Companies to help you decide:

| Feature | Proprietorship | LLP | Company |

|---|---|---|---|

| Number of Owners | Single Owner | Minimum 2 | Minimum 2 |

| Liability | Unlimited | Limited | Limited |

| Formation | Easiest | Moderate | Most Complex |

| Management Structure | Owner-managed | Partner-managed | Board-managed |

| Taxation | Income Tax | Pass-through | Corporate Tax |

| Regulations | Least Regulated | Moderately Regulated | Most Regulated |

| Continuity | Ends with owner | Perpetual | Perpetual |

| Raising Capital | Limited Options | Moderate Options | Easier |

Benefits of LegalShark Legal Service

- Expertise and Experience

- Certified Company Lawyer

- Affordable Pricing

- Fast and Reliable Service

- Customer Satisfaction

Success Stories with LegalShark

Client Reviews for LegalShark's Trademark Registration Services

Ready to Register Your LLP in India?

Schedule a free consultation with our Indian company lawyer today!

Schedule Your Free Consultation Today

Why Chose LegalShark For LLP Registration in India?

We make registration easily and fully comply with the Trademark law.

Startups Assistance

We provide free consultation to all startups and SME's to help boosting or expansion their business.

24X7 Support

No Matter its personal or professional issue, we are standing always with our client.

Funding Opportunities

We believe in your growth so thats why we help our clients to raise funds from investors.

All in One Solution

LegalSark provide complete business solution at one place. So you don't need to bother.

Money Back Guarantee

100% money back guarantee if you fail to provide solution as per you needs.

Expert Company Lawyers

We have best company lawyer who guide you before register a llp in India.

Top 10 FAQs on LLP Registration in India

- Limited Liability Protection: Protects personal assets of partners from business debts.

- Flexible Structure: Partners can define profit sharing, roles & responsibilities in the LLP agreement.

- Separate Legal Entity: The LLP can own property, enter contracts, and be sued in its own name.

- Perpetual Existence: The LLP continues to exist even if there are changes in partners.

- No Minimum Capital Requirement: Easier to establish compared to companies with minimum capital mandates.

- A minimum of two partners are required, with at least one being a resident Indian.

- Partners can be individuals with legal capacity to contract or even other companies.

No, there’s no minimum capital contribution required for LLPs.

- PAN Card (Permanent Account Number) for all partners.

- Passport-sized photographs of all partners.

- Address proof for all partners (Voter ID, Passport, Aadhaar Card, Utility Bill).

- Proposed names for the LLP (up to 6 options).

- Registered office address proof (Rent Agreement & NOC (if rented), Utility Bill).

- Drafted LLP Agreement (optional but recommended).

- Digital Signature Certificate (DSC) for at least one designated partner.

- The process typically involves online filing through the Ministry of Corporate Affairs (MCA) portal.

- Steps include name reservation, partner details submission, agreement filing (if applicable), and online payment of registration fees.

- The cost can vary depending on government fees and professional service charges (if any). It’s generally considered a more affordable option compared to company registration.

- While not mandatory, consulting a lawyer can be beneficial to ensure you meet all requirements and have a legally sound LLP agreement.

- LLPs need to file annual returns and financial statements with the MCA. Specific requirements might vary depending on the nature of the business.

- Yes, it’s possible to convert a proprietorship or a general partnership firm into an LLP by following the prescribed procedure.

LLPs are considered pass-through entities for tax purposes. Profits and losses are passed on to the partners and taxed according to their individual income tax slabs.